Guest Blog: Community Associations and Water Damage

When writing insurance for a condominium association or a homeowner’s association insured like a condominium, there are two integral parts of the insurance program: The association’s Insurance and the unit-owners Insurance. The association’s insurance is responsible for the structures and all common elements (shared walls, drywall, shared plumbing, shared electric, etc.) as originally built, barring no insurance amendments to the association’s governing documents. The unit- owner’s insurance policy is helpful for covering all of their personal property and contents.

When writing insurance for a condominium association or a homeowner’s association insured like a condominium, there are two integral parts of the insurance program: The association’s Insurance and the unit-owners Insurance. The association’s insurance is responsible for the structures and all common elements (shared walls, drywall, shared plumbing, shared electric, etc.) as originally built, barring no insurance amendments to the association’s governing documents. The unit- owner’s insurance policy is helpful for covering all of their personal property and contents.

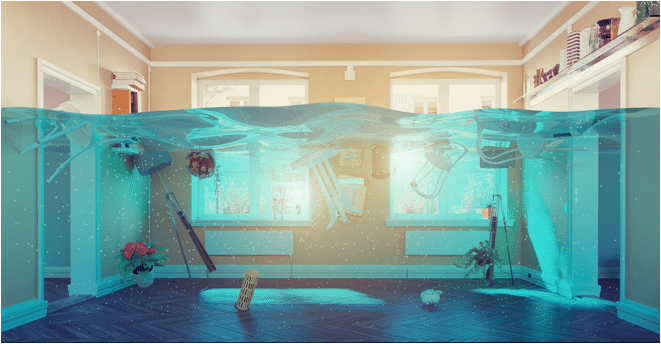

The latest trending claim is related to past water damage occurrences and the unit-owner’s insurer trying to recoup their paid expenses from the association via subrogation. Normally, when the association has a water damage claim from a bursting pipe that is considered “shared plumbing”, the association typically takes care of the plumbing and the drywall. The unit-owner takes care of the drywall finishes, the floor coverings, the cabinets, the furniture, etc.

Now, we are frequently seeing the unit-owner’s insurance carrier come back to the association seeking potential reimbursement on these water damage claims via subrogation. The unit-owner’s insurer will normally state that there is negligence on the association’s behalf for not maintaining the common element, causing this loss to occur. These notices/demands normally come in the form of a letter or email from the homeowner’s insurance carrier, this is the document that you should provide to your association’s insurance advisor for review.

This is a claim that we need to be notified about immediately. This type of claim gets reported to your general liability policy so a licensed adjuster can review with you and determine if the association is legally responsible for any of the damages being pursued. So far, we have seen the majority of these claims result in liability denials to the homeowner’s carriers because the association was deemed not responsible, but we have also seen some settled, and everyone moves on. If ignored, the homeowner’s insurer may file a lawsuit against the association.

What does this mean for the future of your association’s insurance program?

The association’s carrier is starting to see these claims at a very high volume and some are from 1-3 years ago. It’s fair to anticipate general liability rate increases, or this type of loss will be a listed exclusion. It is important to work with an Insurance advisor that works in the Community Association Industry so that you are in good hands.

If you have any questions, please contact me directly:

David Mohns, CIRMS, AAI, CLCS, LCAM

Vice President

Bouchard Insurance

Direct: (727) 373-2947

Email: Davidmohns@bouchardinsurance.com